Debt-to-Equity Ratio: calculation, benchmark

Taking a broader view of a company and understanding the industry its in and how it operates can help to correctly interpret its D/E ratio. For example, utility companies might be required to use leverage to purchase costly assets to maintain business operations. But utility companies have steady inflows of cash, and for that reason having a higher D/E may not spell higher risk. If preferred stock appears on the debt side of the equation, a company’s debt-to-equity ratio may look riskier. On the other hand, companies with low debt-to-equity ratios aren’t always a safe bet, either. For example, a company may not borrow any funds to support business operations, not because it doesn’t need to but because it doesn’t have enough capital to repay it promptly.

Step 1: Identify Total Debt

✝ To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. This ratio compares a company’s equity to its assets, showing how much of the company’s assets are funded by equity. Ultimately, businesses must strike an appropriate balance within their industry between financing with debt and financing with equity. In order to calculate the debt-to-equity ratio, you need to understand both components. Gearing ratios focus more heavily on the concept of leverage than other ratios used in accounting or investment analysis.

Impact on Investment Decisions

- Another example is Wayflyer, an Irish-based fintech, which was financed with $300 million by J.P.

- It shines a light on a company’s financial structure, revealing the balance between debt and equity.

- The 10-K filing for Ethan Allen, in thousands, lists total liabilities as $312,572 and total shareholders’ equity as $407,323, which results in a D/E ratio of 0.76.

- The D/E ratio illustrates the proportion between debt and equity in a given company.

Here, “Total Debt” includes both short-term and long-term liabilities, while “Total Shareholders’ Equity” refers to the ownership interest in the company. Investors often scrutinize the Debt to Equity ratio before making investment decisions. A company with a high ratio might be seen as risky, whereas one with a lower ratio could be viewed as more stable. Different sectors have varying norms, and it’s essential to compare against industry averages.

What is your current financial priority?

For example, if a company, such as a manufacturer, requires a lot of capital to operate, it may need to take on a lot of debt to finance its operations. This ratio, which equals operating income divided by interest expenses, showcases the company’s ability to make interest payments. Generally, a ratio of 3.0 or higher is desirable, although this varies from industry to industry. This ratio indicates that the higher the degree of financial leverage, the more volatile earnings will be. Since interest is usually a fixed expense, leverage magnifies returns and EPS.

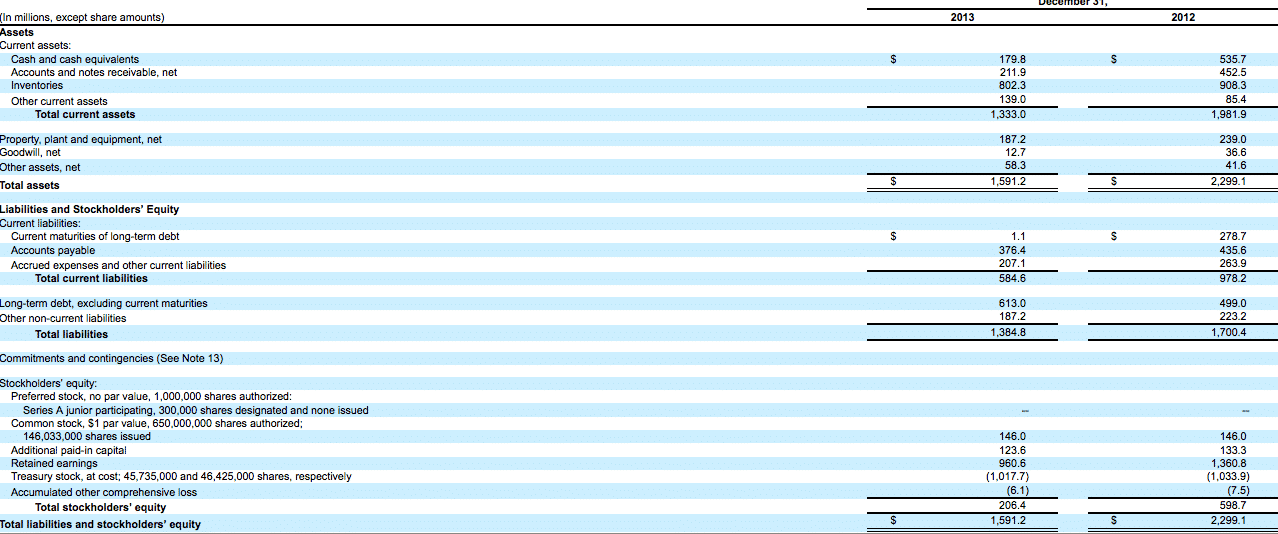

Some investors also like to compare a company’s D/E ratio to the total D/E of the S&P 500, which was approximately 1.58 in late 2020 (1). It’s also helpful to analyze the trends of the company’s cash flow from year to year. You can calculate the D/E ratio of any publicly traded company by using just two numbers, which are located on the business’s 10-K filing. However, it’s important to look at the larger picture to understand what this number means for the business. It’s clear that Restoration Hardware relies on debt to fund its operations to a much greater extent than Ethan Allen, though this is not necessarily a bad thing. You can find the balance sheet on a company’s 10-K filing, which is required by the US Securities and Exchange Commission (SEC) for all publicly traded companies.

Create a Free Account and Ask Any Financial Question

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. For instance, if Company A has $50,000 in cash and $70,000 in short-term debt, which means that the company is not well placed to settle its debts. If the company is aggressively expanding its operations and taking on more debt to finance its growth, the D/E ratio will be high. Investors, lenders, stakeholders, and creditors may check the D/E ratio to determine if a company is a high or low risk. In contrast, service companies usually have lower D/E ratios because they do not need as much money to finance their operations.

That’s because share buybacks are usually counted as risk, since they reduce the value of stockholder equity. As a result the equity side of the equation looks smaller and the debt side appears bigger. If earnings don’t outpace the debt’s cost, then shareholders may lose and stock prices may fall. In some cases, creditors limit the debt-to-equity ratio a company can have as part of their lending agreement.

For example, Nubank was backed by Berkshire Hathaway with a $650 million loan. In the majority of cases, a negative D/E ratio is considered a risky difference between balance b f and balance c f explained sign, and the company might be at risk of bankruptcy. However, it could also mean the company issued shareholders significant dividends.

Leaver a comment